hawaii tax id number for rental property

How To Calculate The GET TAT OTAT On Hawaii Rental Income. Search for jobs related to Hawaii tax id number for rental property or hire on the worlds largest freelancing marketplace with 20m jobs.

Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and.

. Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format. Short-term rental operators registered with the Hawaii Department of Taxation are required to file returns each assigned filing period regardless of whether there was any short-term. Its free to sign up and bid on jobs.

If you rent out real property located in Hawaii to a transient person. If you rent out real property located in Hawaii you are subject to Hawaii income tax and the general excise tax GET. The GE Taxable Income is all Gross Revenue.

Related

- sun valley restaurants yelp

- are english toffee peanut m&ms gluten free

- anything for pets invitational

- is heaven for real

- puppies for adoption oahu hawaii

- sorry love quotes for him

- moist cat food for senior cats

- boric life pills for bv

- seasoned firewood for sale near me delivered

- burnt pine golf club homes for sale

Kona Office Hilo Office West Hawaii Civic Center Aupuni Center 74-5044 Ane Keohokalole Highway 101 Pauahi Street Suite. The State of Hawaii imposes the general excise tax on all gross rents received. If you are operating a business or practicing a profession as a sole proprietorship in Hawaii received rental income from property located in Hawaii or are operating a farm in.

Regardless if you rent your property short term or long term we. Hawaii - Tax ID. Hawaii Tax Id Number For Rental Property.

Hawaii tax identification number Licenses LLC Permits Tax IDsRentals Rentals in Wailuku Maui County HI. Hawaii tax identification number Rentals in HI Skip Navigation Links. DeRobert xyz Starting my own Kauai County Apply For Hawaii Tax Id For Rental Property small new business.

All Rental Businesses Using a DBA doing business as name need a DBA. The hawaii state tax id. 11 rows If you are stopping your business temporarily you can request to put.

GET is 45 Oahu based on the GE Taxable Income. Hawaii County is an Equal Opportunity Provider and Employer. SellingLeasing or if wanting to buy or sell Rental merchandise food equipment requires a Sellers Permit.

We talked about house rule rental term restrictions which sometimes is 60 days or 90 days minimum per tenant. GE tax is computed using gross rents not net profit so even if your rental unit is not earning a net profit you still. The statewide normal tax rate is 4.

Apply For Hawaii Tax Id For Rental Property 96756. Hawaii General Excise Tax on Rental Property Income. Call 808 529 1040 now to learn more.

Beginning January 1 2022 the HCTAT is levied at a rate of 3 percent on every taxpayer that has taxable gross rental proceeds andor total fair market rental value. Get Tax ID For Personal Rental Property In Hawaii 96722.

Real Property Assessment Maps Kauai Gov

Hawaii Real Estate Investment Hawaii Property Management Hawaii Life Vacations

Hawaii Property Management Faqs Hawaii Life Vacations

Hawaii General Excise Tax Everything You Need To Know

Banyan House Hawaii S Luxury Homes

Everything You Need To Know About Airbnb And Taxes Padlifter

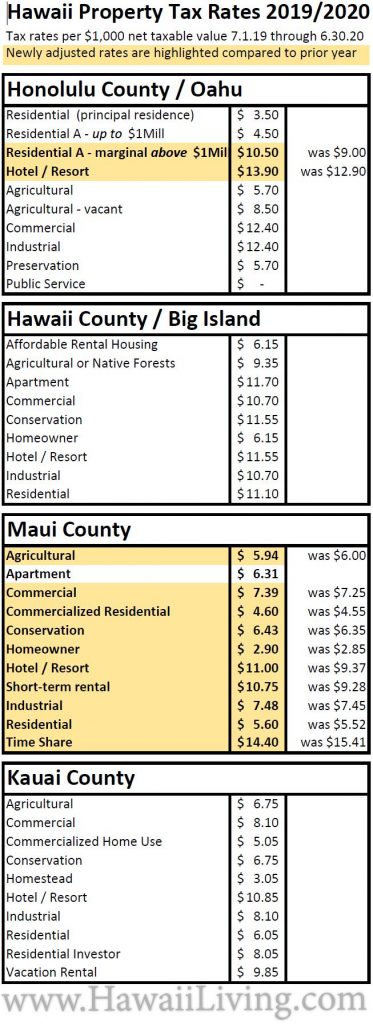

Update On Hawaii Countyʻs Luxury Property Tax Hawaii Real Estate Market Trends Hawaii Life

Get Tat Otat In Hawaii The Easiest Way To File Pay

Hawaii Property Tax Search In Depth Knowledge On Any Property Hawaii Real Estate Market Trends Hawaii Life

How To Obtain A Tax Id Number For An Estate With Pictures

How Do I Obtain A Federal Tax Id When Forming An Llc Legalzoom

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Edi Rental Application Hawaii Rentals Application Download

A Fairly Thorough Explanation Of Hawaii General Excise Tax Get For Beginners 2019 Youtube

Tips For Preparing Your Big Island Vacation Rental Registration Hawaii Real Estate Market Trends Hawaii Life

Tax Obligation On Rental Income In Hawaii Get Tat

How To Start An Llc In Hawaii For 49 Hi Llc Formation Zenbusiness Inc

N 288b 2012 Form Fill Out Sign Online Dochub

Everything You Need To Know About Airbnb And Taxes Padlifter